Is a Donor-Advised Fund for Charitable Giving a Good Fit?

A donor-advised fund (DAF) is a charitable giving account that can play a valuable role in a charitable giving strategy—popular for its tax efficiency, flexibility, and simplicity. This resource can help you determine if a DAF could be worth considering as a useful addition to your overall …

Charitable Giving Strategies in a High-Income Year

The end of the year offers an ideal opportunity to look both forward and backward—reflecting on recent achievements while setting goals for the upcoming months. For many people, it’s also a time to review their finances and identify charitable moves that can help lower their tax bill. If y …

Including Charitable Giving in Your Financial Planning

If you’re interested in making a lasting impact for the causes that matter most to you, you may want to include charitable giving in your financial plan. In this on-demand webinar, Carson’s Heather Zack, Private Client Services – Solutions Strategist, will share information about charitable …

How Can I Donate in the Most Efficient Way Possible?

There are countless ways to give—from dropping off your old couch at local donation center to volunteering at the local soup kitchen. When it comes to monetary gifts, it’s worth thinking through how to give in a way that both supports your values and helps maximize tax savings.

How Estate and Gift Taxes Can Impact Your Financial Plan

Giving something you own to someone else. It’s a simple, human act – one that seems like it shouldn’t take too much planning to do it correctly. But when does gifting become a tax issue? What do you need to consider about gifting as it relates to your overall estate plan?

Why You Might Need a Power of Attorney

Have you thought about your legacy? We highly recommend that you appoint a trusted family member or friend as your power of attorney (POA), giving them the ability to help with your financial or health needs, should an unfortunate event occur in your life.

7 Tips to Successfully Transfer Wealth to Your Kids

70% of family wealth is lost by the end of the second generation and 90% by the end of the third. Get our step-by-step guide to help you successfully pass your wealth to the next generation. Download Guide

Knowing When to Update Your Estate Plan

From the family tea set to the most complex estate, transferring wealth is quite common. What’s less common, but just as important, is outlining a specific plan for this transfer and updating it as circumstances change.

Philanthropic Risk Management: Ensuring Effective and Compliant Giving

The Foundations of Philanthropic Financial Planning If you’ve been thinking about donating to causes that are important to you but have not yet pulled the trigger, or your giving plan simply consists of giving to places like your child’s school or your church or community group when they as …

Estate Planning for High Net Worth Individuals: A Guide to Estate Equalization

As someone with a significant estate to leave, deciding who you leave it to and how you leave it are clearly important. Your personal preferences and the potential good your bequests can do are factors to think about in your estate planning. So is fairness — especially if you have several c …

COMPLIMENTARY RESOURCE

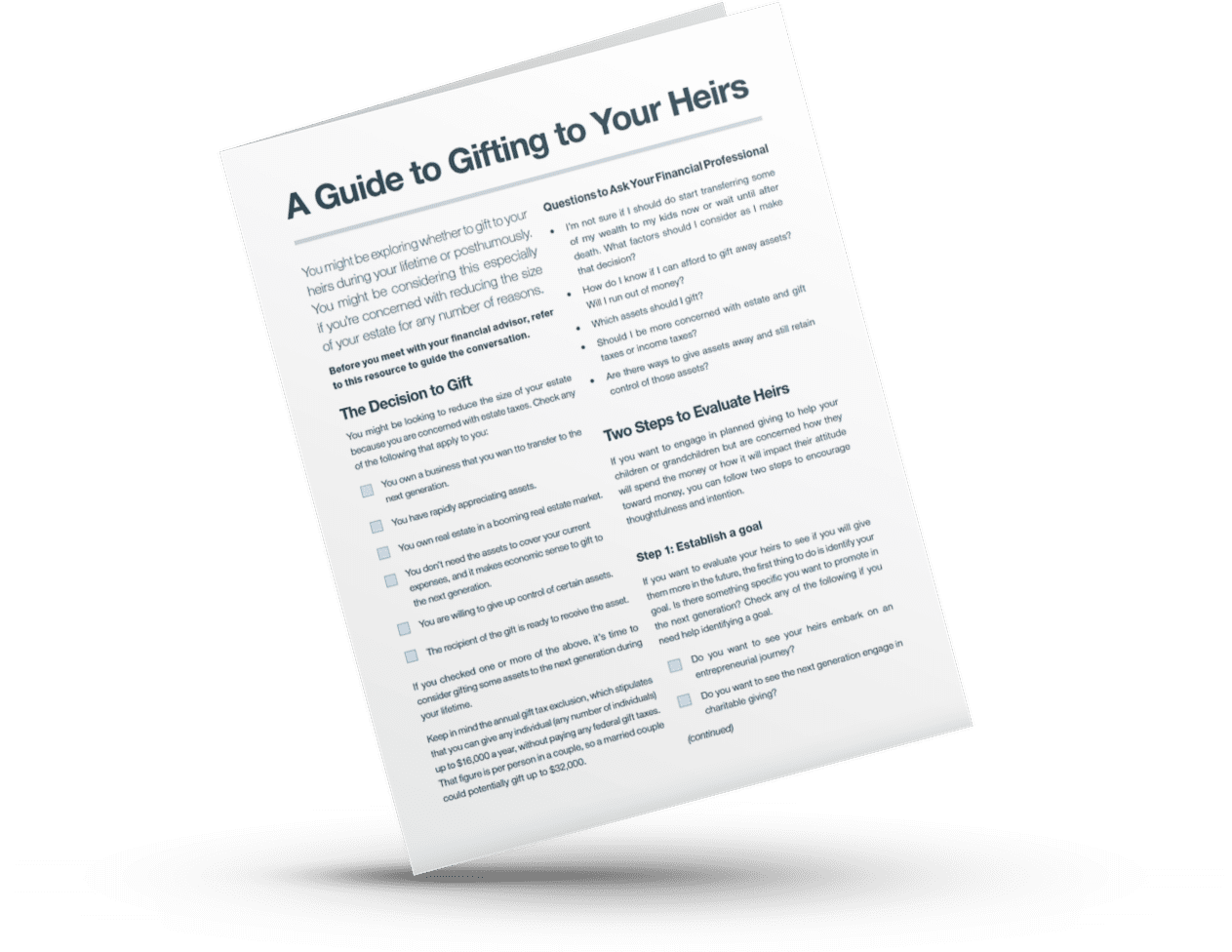

A Guide to Gifting to Your Heirs

Gifting to your loved ones now or posthumously each carries their own positives and negatives as they relate to your estate plan, taxes, your goals and your legacy.